A to Z Tally Receipt Voucher Transactions Entry | Complete Guide | Pradip VedantSri

In the world of accounting and business management, A to Z Tally Receipt Voucher Transactions Entry is a fundamental skill that every professional must master. As we move into 2026, with trends like automated accounting, AI-assisted bookkeeping, and real-time financial analytics gaining momentum, understanding the core principles of recording money received is more crucial than ever. This complete guide, inspired by the detailed video tutorial by Pradip VedantSri, will walk you through every possible transaction you can record using a Receipt Voucher in Tally Prime. Whether you’re a business owner, a student, or an accounting professional, this guide will serve as your definitive resource for handling all types of monetary inflows accurately.

Why the Receipt Voucher is Your Financial Cornerstone

A Receipt Voucher in Tally is used to record all transactions where money enters your business. It is the primary document for logging any cash or bank receipts, ensuring your books reflect a true and fair view of your financial health. In 2026, with the rise of blockchain receipts and digital audit trails, the foundational principle remains the same: every incoming rupee must be accounted for correctly. Mastering this voucher type is the first step towards robust financial control, clean books, and seamless GST compliance.

Link: –Tally Course Fees, Duration, Scope, Syllabus, Admission, Institutes & Jobs in Varanasi

Complete Breakdown of Receipt Voucher Transactions

The following table categorizes the primary types of transactions you will record through a Receipt Voucher, as explored in depth in the accompanying video tutorial.

| Transaction Category | Key Purpose | Common Example |

| Capital & Loan | Funds introduced as owner’s capital or borrowed money | Owner investing money, Bank Loan received |

| Income & Sales | Revenue from operations or asset disposal | Sale of goods, Selling an old vehicle |

| Advances & Deposits | Money received as security or for future supply | Security Deposit from tenant, Advance from customer |

| Refunds & Adjustments | Money received back or year-end corrections | GST Refund from department, Year-end adjustment entry |

Let’s delve into each type of transaction in simple, actionable detail.

1. Capital Account Transactions

When you, as the business owner, inject personal funds into the business, it is recorded here. This increases the company’s cash/bank balance and correspondingly increases the Capital Liability owed to the proprietor. It’s the starting point of most business financial journeys.

2. Loan Account Transactions

This covers all borrowed funds. It’s vital to categorize them correctly for accurate liability tracking.

- Secured Loan: Loans backed by collateral (e.g., Mortgage, Loan against property).

- Unsecured Loan: Loans without collateral (e.g., Personal loan from a friend, certain Bank OD).

- Loan Liability: This records the principal portion of any loan received, creating a payable obligation in your books.

3. Bills Receivable Transactions

When you receive money against outstanding invoices or dues from customers, you use this.

Link: –Tally Course Fees, Duration, Syllabus, Scope, Top 5 Jobs and Best Institutes in Varanasi

- Advance Receive: Payment received before supplying goods or services.

- Against Reference: Partial or full payment against a specific existing invoice.

- New Reference: Creating a new invoice while receiving payment.

- On Account: Receiving a general payment not linked to a specific invoice yet.

4. Recording Income

All revenue generation is recorded here, split for better analysis.

- Direct Incomes: Income core to your business (e.g., Sales Revenue, Service Income).

- Indirect Incomes: Incidental income (e.g., Discount Received, Commission Received).

5. Sale of Fixed Assets

When you sell a capital asset like a computer, machinery, or car, the money received is not income. It is recorded here to reduce the asset’s value in your books and may result in a profit or loss on sale.

6. Refunds and GST

- Refund Received: Money paid earlier is returned (e.g., advance tax refund, vendor refund).

- GST Refund Received: A critical entry for claiming refunds from the government for accumulated Input Tax Credit (ITC) or exports. This is a key area for 2026 GST compliance.

7. Deposits and Advances

- Security Deposit Received: Refundable amounts taken for safety (e.g., from tenants, against rentals).

- Quotation Advance Received: Advance money received in response to a quotation submitted.

8. Loan Repayments and Unclaimed Money

- Loan Repayment Received: Recording when a party repays the loan you had given them.

- Unclaimed Money Received: Accounting for old dues or liabilities that were written off but are now received.

9. Year-End Adjustments Received

At the financial year closing, you may need to record receipts for accrued income or adjustments discovered during audit, ensuring your final statements are perfect.

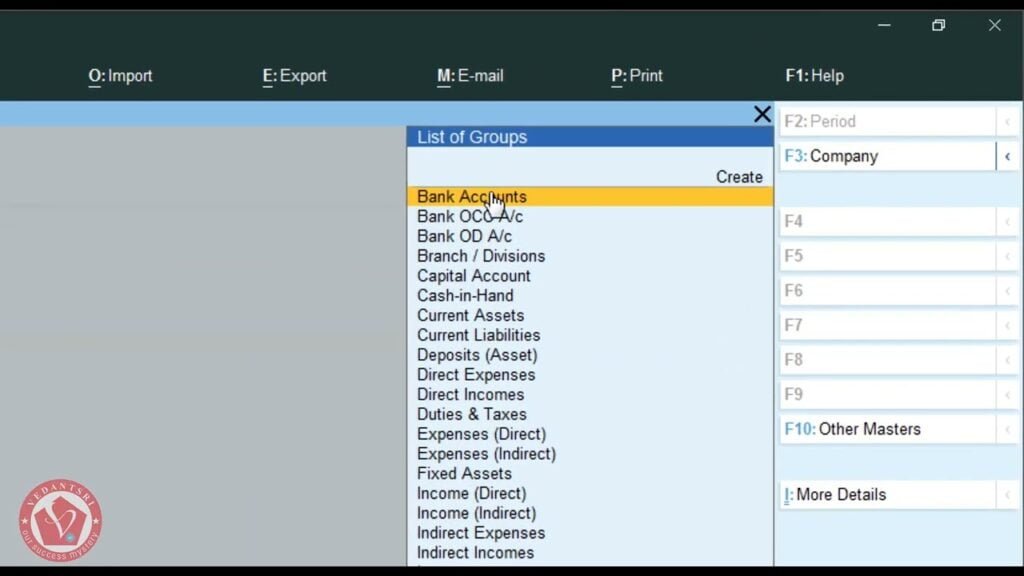

Step-by-Step Process for Entry in Tally Prime

To record any of the above transactions in Tally Prime (2026 edition), follow this universal process:

- Go to Gateway of Tally > Voucher > Receipt (F6).

- The date will be auto-filled, but ensure it’s correct.

- In the “Received From” field, select the party or ledger from whom money is coming.

- Enter the amount.

- In the lower part, “Against” select the appropriate ledger account (e.g., Sales Account, Loan Account, Capital Account, based on the transaction type listed above).

- Add a narration for clarity (e.g., “Received as Secured Loan from ABC Bank”).

- Press Enter to save.

Conclusion: Your Path to Flawless Bookkeeping

Understanding the A to Z Tally Receipt Voucher Transactions Entry is not just about data entry; it’s about comprehending the story behind every rupee that enters your business. In 2026, as software becomes more intelligent, the accountant’s role shifts from mere recording to strategic categorization and analysis. By mastering these 12+ transaction types, you build an unshakable foundation for financial reporting, GST filing, and business decision-making.

For a visual, step-by-step walkthrough of each transaction with real-time Tally Prime screens, be sure to watch the complete video guide by Pradip VedantSri embedded below. Seeing these entries performed live will solidify your understanding and equip you to handle any receipt scenario in your professional journey.

📌 Hashtags: #Tally #TallyERP9 #TallyPrime #ReceiptVoucher #TallyAccounting #TallyCourse #TallyTutorial #AccountingBasics #TallyLearning #VedantSri

📌 Search Query: Tally ERP 9, Tally Prime, Tally Receipt Voucher, Receipt Voucher Entry, Tally Accounting, Tally Transactions, How to enter receipt voucher in Tally, Receipt entry in Tally, Tally course, Tally tutorial, Tally learning, Tally classes, Tally training, Tally for beginners, Business accounting, GST in Tally, Bank receipt entry, Cash receipt entry, Tally step by step, Accounting in Tally, Tally ERP 9 tutorial, Tally Prime tutorial, Pradip VedantSri, VedantSri Tally